|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home After 1 Year: A Comprehensive GuideRefinancing your home after just one year may seem quick, but under the right circumstances, it can be a smart financial move. This guide delves into the hows and whys of refinancing early, exploring potential benefits, challenges, and considerations. Understanding the Basics of RefinancingRefinancing involves replacing your existing mortgage with a new one, ideally with better terms. Homeowners typically refinance to lower their interest rates, reduce monthly payments, or change the loan's term. Reasons to Consider Refinancing After One Year

Steps to Successfully Refinance EarlyBefore jumping into refinancing, it's crucial to evaluate your financial situation and understand the steps involved. First, assess your home's equity and research current rates. It's also beneficial to use online resources such as how do i refinance my house for detailed guidance. Calculate the Costs

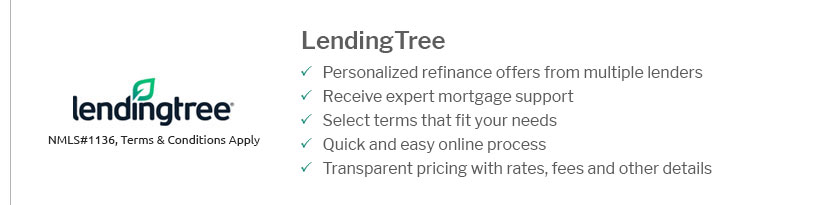

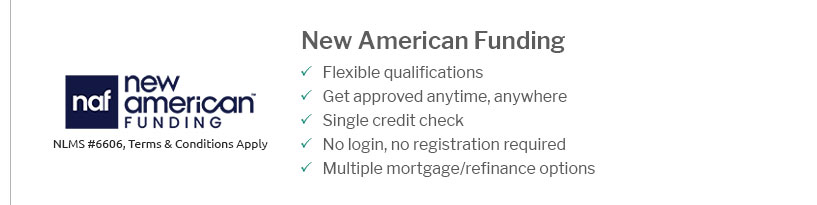

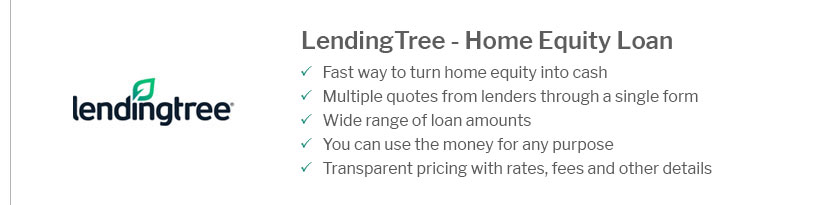

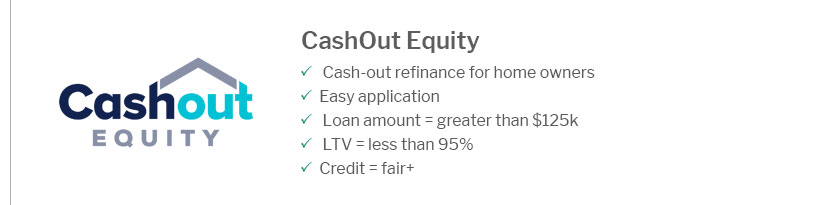

Choose the Right LenderFinding the right lender is crucial. Consider shopping around and comparing offers. Websites like how do you refinance a house can help you explore different lenders and options available. Potential Challenges and ConsiderationsRefinancing early is not without its drawbacks. Lenders might impose a prepayment penalty for paying off your original mortgage early. Additionally, refinancing may reset the term of your loan, potentially increasing the total interest paid over time. Market ConditionsThe real estate market's condition can impact your refinancing decision. A market downturn might affect your home's value and equity, making it challenging to secure favorable terms. Frequently Asked QuestionsIs it too soon to refinance my home after 1 year?Refinancing after one year can be beneficial if interest rates have significantly decreased or if your credit score has improved. However, you should carefully evaluate the costs and benefits before proceeding. What are the typical costs associated with refinancing?Refinancing typically involves closing costs, which can range from 2% to 5% of the loan amount. It's essential to calculate these costs against the potential savings to determine if refinancing makes financial sense. Can refinancing affect my credit score?Yes, applying for a refinance can temporarily lower your credit score due to the hard inquiry on your credit report. However, consistent on-time payments on your new loan can improve your score over time. https://www.cbsnews.com/news/how-soon-refinance-mortgage/

With a standard rate-and-term refinance, you'll need to wait at least 210 days from your original loan's closing date. https://www.reddit.com/r/personalfinance/comments/4k1g64/have_had_a_mortgage_for_1_year_should_i_refinance/

However, going from a 30 year to a 20 year will save you a lot of interest over the life of the loan but obligate you to a higher payment even ... https://www.quora.com/What-are-the-drawbacks-of-refinancing-a-home-loan-after-one-year

And that you should keep it at least five years or plan to keep it at least five years after refinance. This is what good mortgage broker say.

|

|---|